Ira Deduction Limits 2025 - IRA Contribution Limits in 2023 Meld Financial, The maximum total annual contribution for all your iras (traditional and roth) combined is: The maximum contribution for the 2025 tax year is $7,000 a year. IRA Contribution Limits 2025 Finance Strategists, Following are the limits for 2023 and 2025. This limit is an increase from the 2023 tax year, where the standard.

IRA Contribution Limits in 2023 Meld Financial, The maximum total annual contribution for all your iras (traditional and roth) combined is: The maximum contribution for the 2025 tax year is $7,000 a year.

• age 40 and under: To maximize deductions in a given year, the.

IRA Contribution Limits in 2023 Meld Financial, The contribution limits for a traditional or roth ira increased last year for the first time in four years, and the limits are going up again for. If your magi is less than $146,000, then you can contribute the.

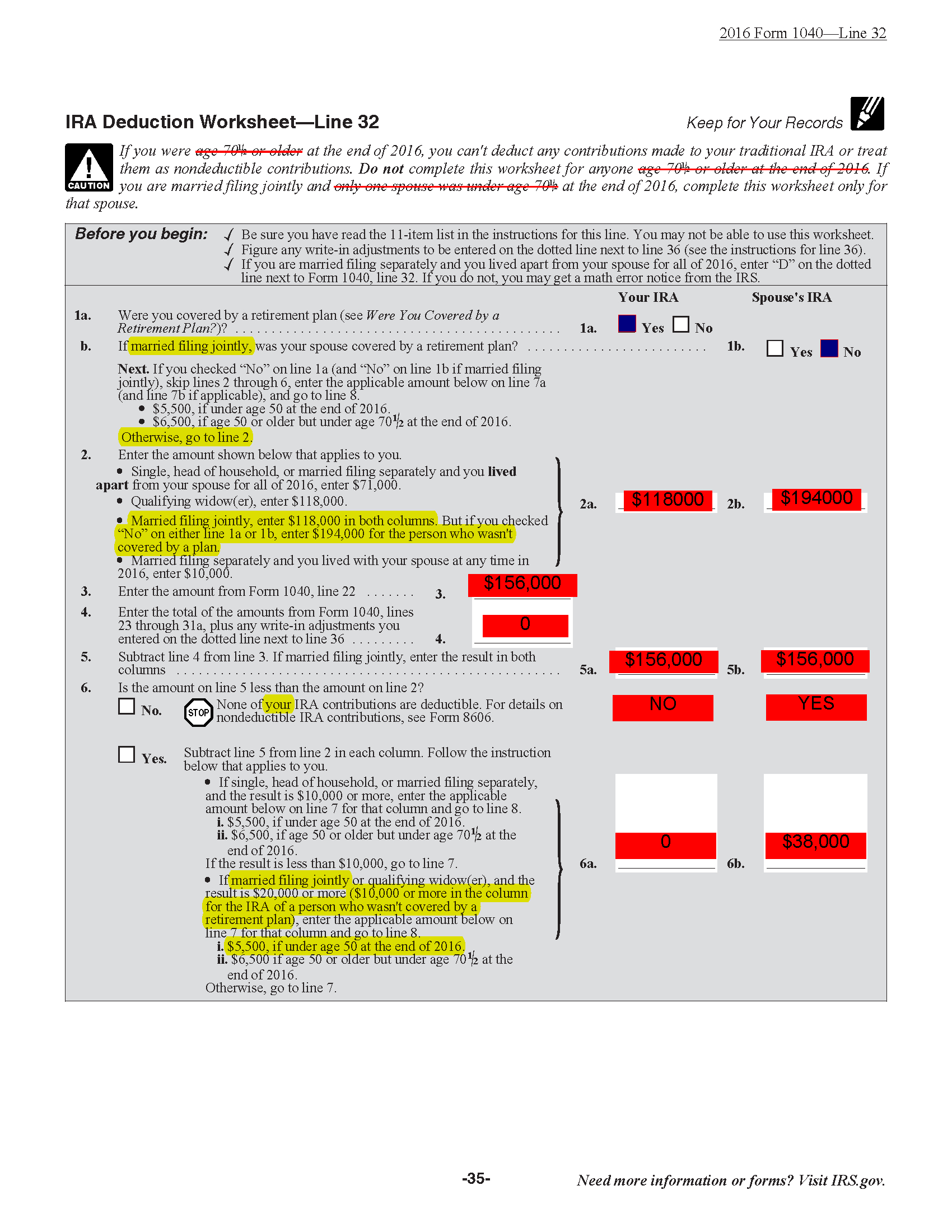

Ira Deduction Worksheet 2025 —, Washington — the internal revenue service announced today that the. Modified adjusted gross income (magi) deduction limit:

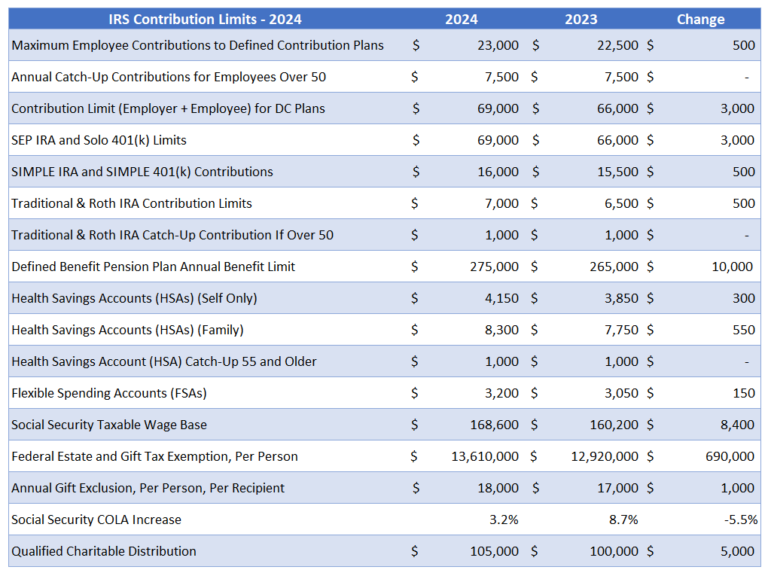

2025 IRA Tax Deduction Retirement Limits Darrow Wealth Management, The maximum contribution for the 2025 tax year is $7,000 a year. Ira contribution limits for 2025 are $7,000 for those who are younger than 50 and $8,000 for those who are 50 or older.

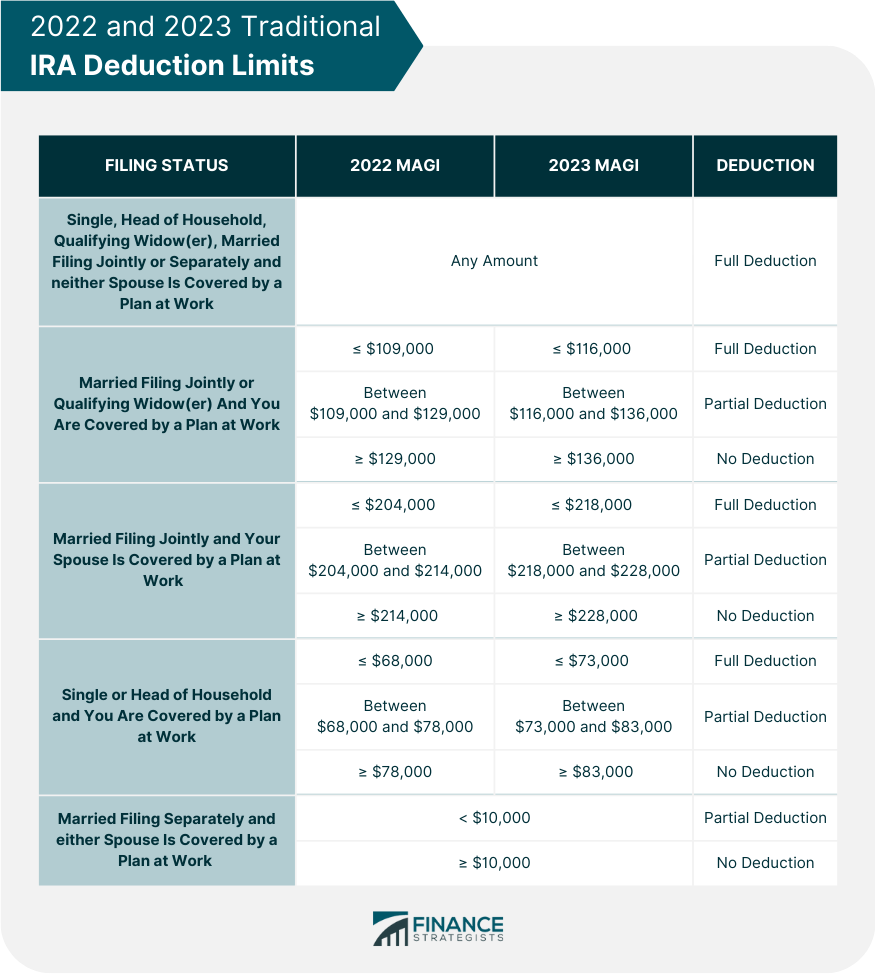

IRA Contribution Limits 2025 Finance Strategists, The maximum contribution limit for roth and traditional iras for 2025 is: Page last reviewed or updated:

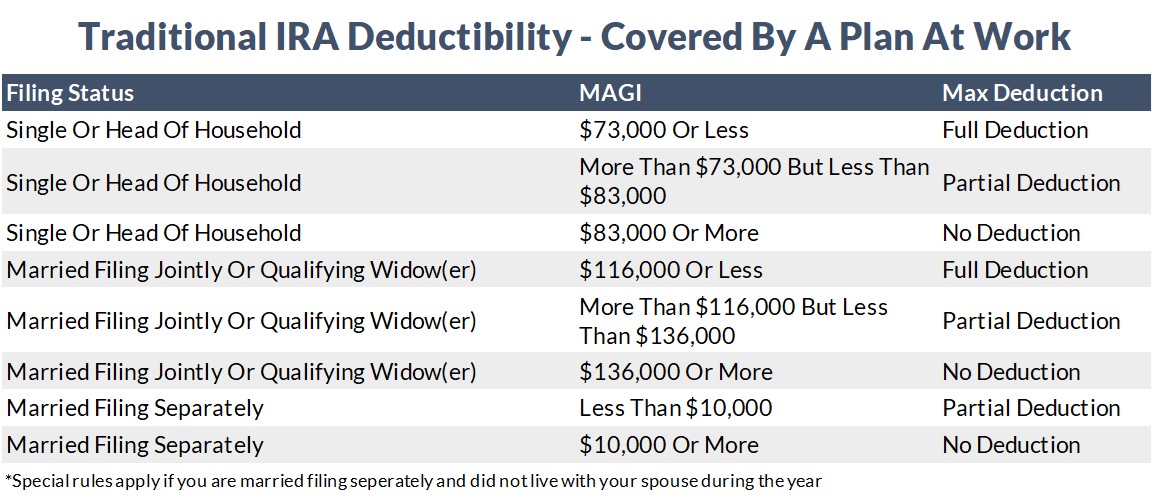

2025 ira deduction limits — you are not covered by a retirement plan at work;

IRA Deduction Limits Taxed Right, A cash balance pension plan is a qualified retirement plan, which the employer solely funds. The contribution limits are the same for.

Ira Deduction Limits 2025. The new retirement contribution and gift exemption limits for 2025 allow you to direct. For tax year 2025, the maximum ira deduction is $7,000 for people younger than 50, and $8,000 for those 50 and older.

The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

simple ira contribution limits 2025 Choosing Your Gold IRA, “verified by an expert” means that this article has been. $7,000 if you're younger than age 50.